Written by Emiley Phillips

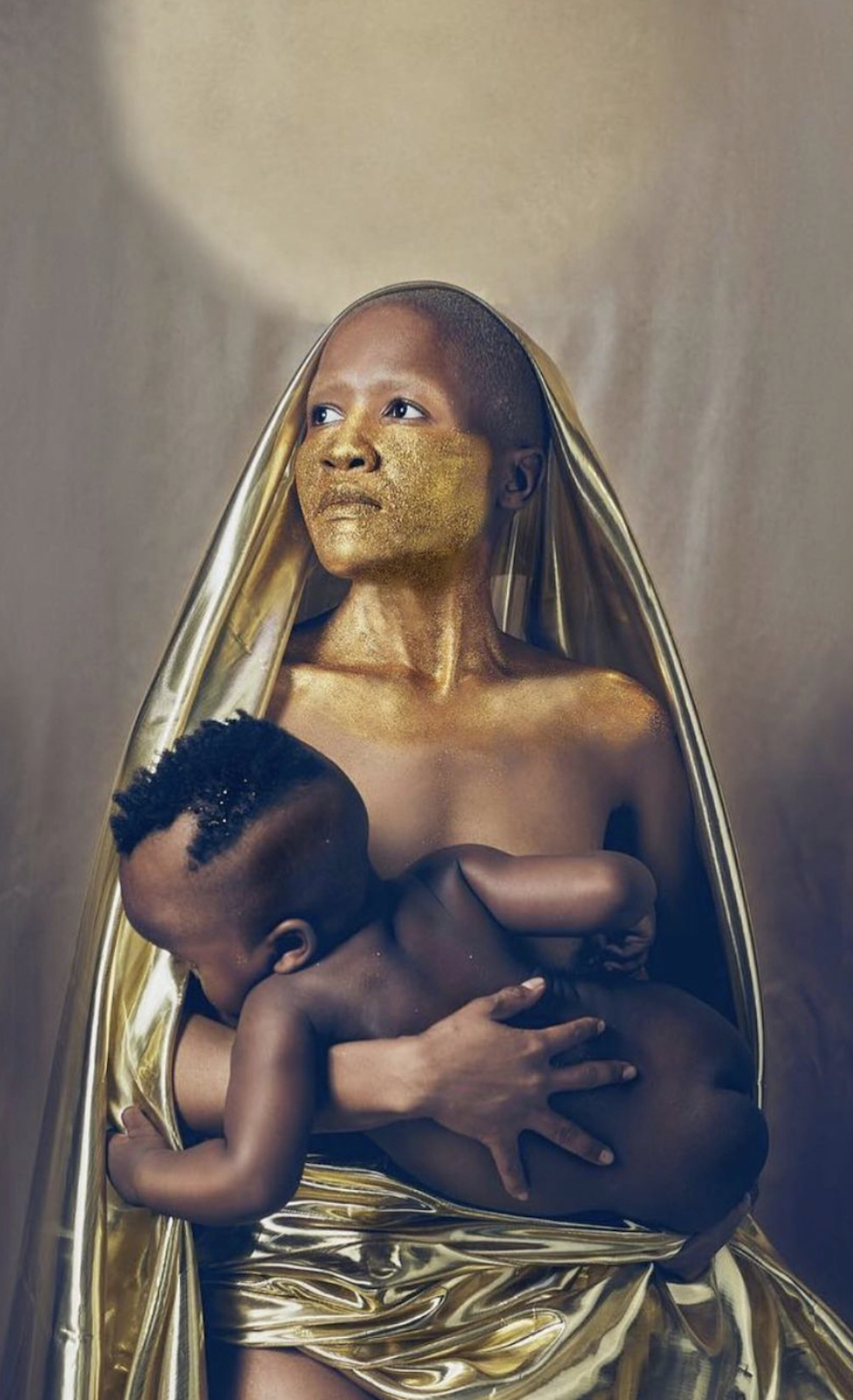

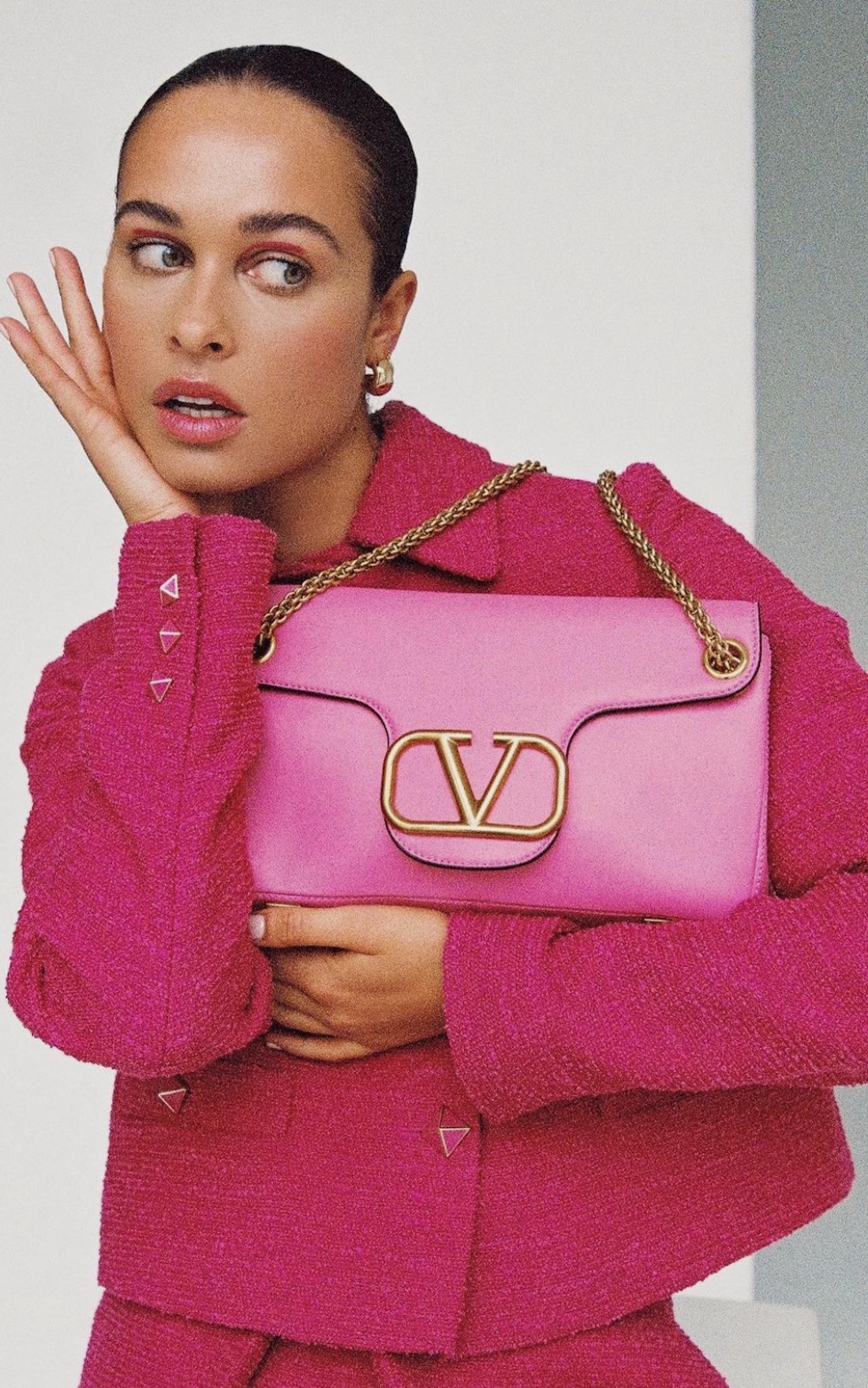

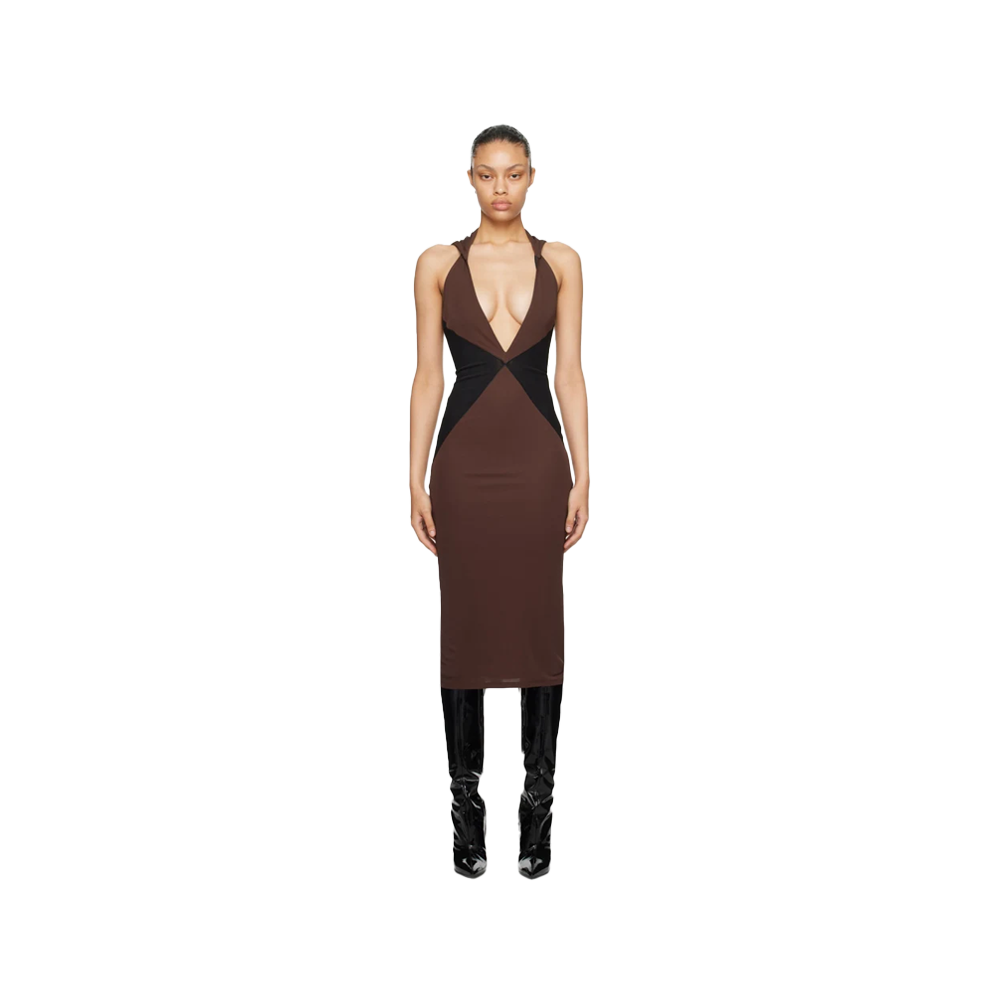

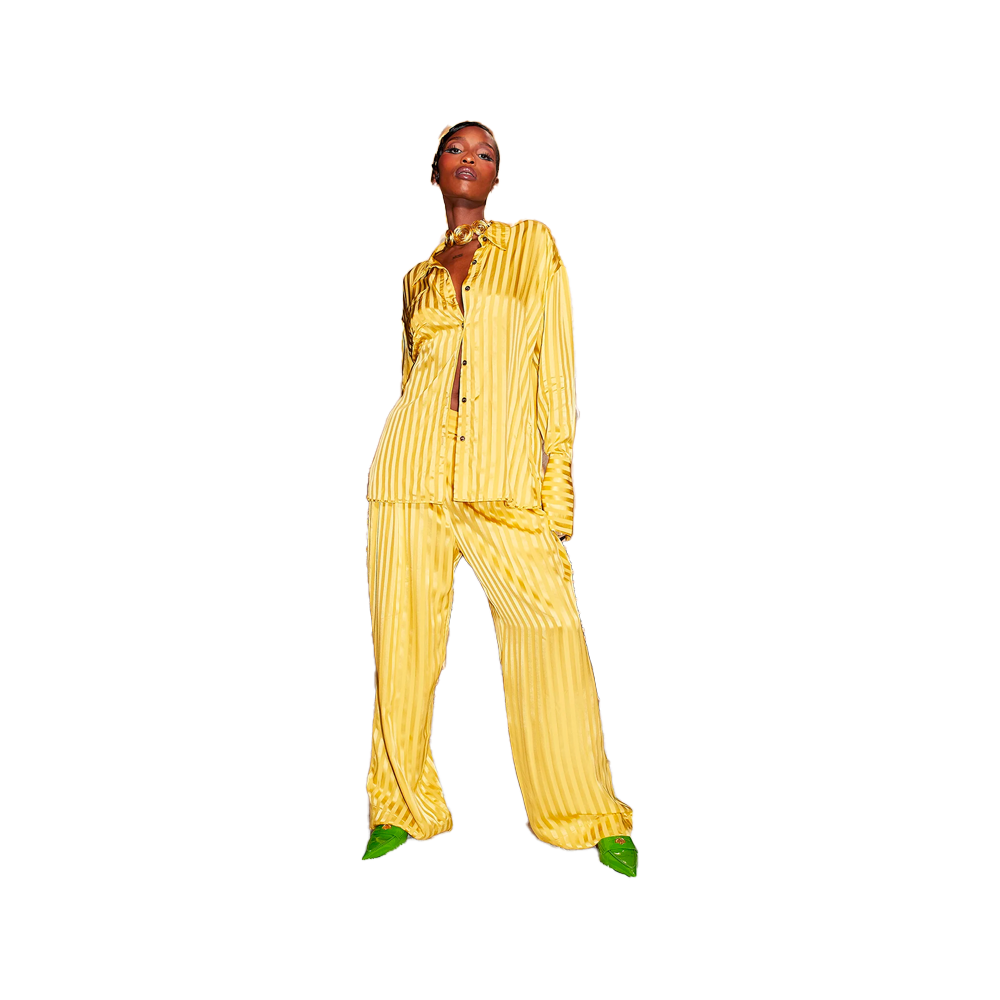

Image by @aurelietshiama

We all have life goals, right? They say the three most common are to buy/own property, to get married, and to have a child. Sounds good – but of course, none of these come easy – not for us millennials anyway! We must work for it, make it happen, and prepare. In the case of goal uno, buying a property involves saving…saving A LOT!

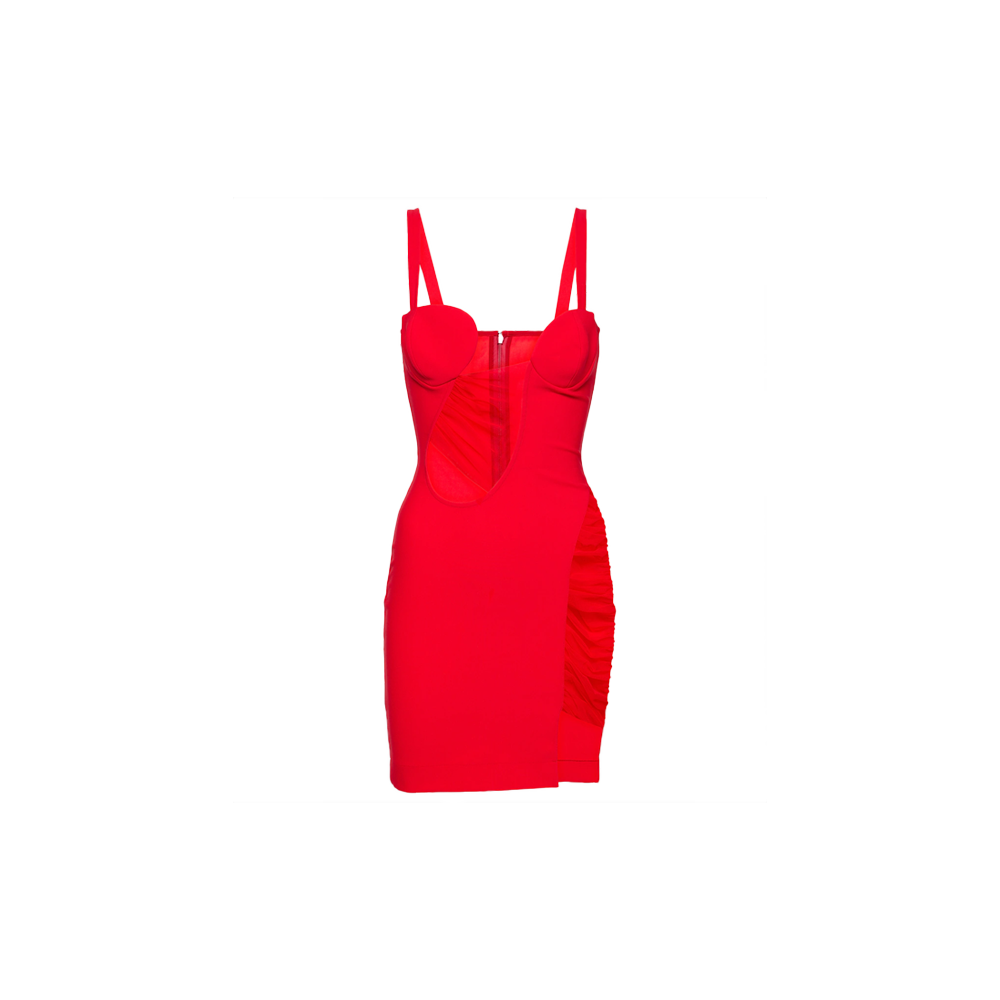

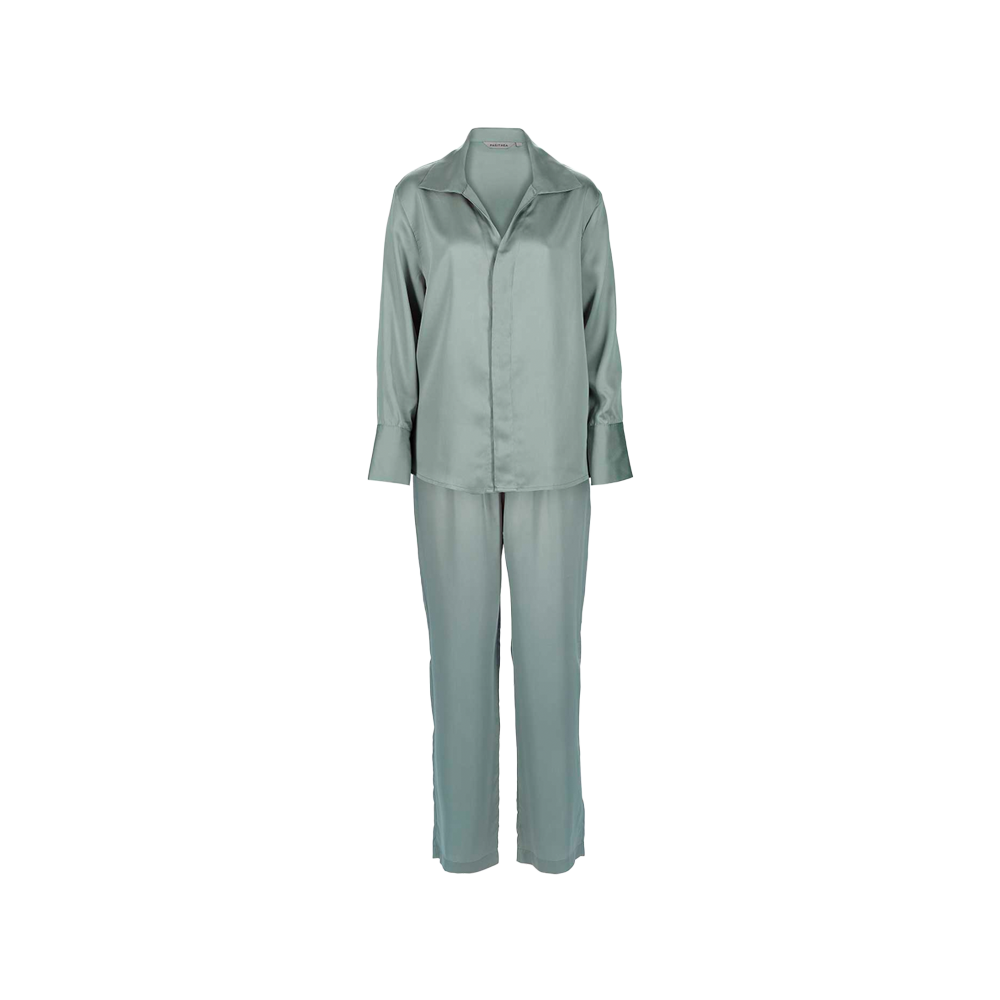

To the dream…living a lavish life, with a beautifully decorated house, stylish interior, and a picturesque exterior – yes please huns! To the reality…earning £2,000 a month yet to make the dream happen to have to save a certain amount, say £500 per month minimum, which can be tough. Slowly by slowly, the daily glamorous life diminishes. Forget about the nights out, organic food, and cute handbags. When it comes to buying a house, expect more nights in, basic necessities only, and certainly fewer treats. This being said – we are here to help you out and share three top tips so that the dream and reality can both be satisfied.

Analyse your cash flow

Before each month begins, create a spreadsheet and list all your expected incomings and outgoings. This should include any occasions/gifts you have planned, as well as any extra income. Make the numbers specifically for the period. From this, you can see what you are expected to have left. Now comes the tough bit. Go through each expected fund and ask yourself how important it is. Do you really need to go out for that meal? Or can you save money by getting takeout instead? Similarly, ask yourself how likely it is, and make the right things happen – will you be able to do overtime at work? Be sure to accept the offer if it comes to you. See where you can make beneficial changes to work in your favour.

Of course, with this comes a realistic mind. You cannot turn down all of the fun stuff because you need to save for something in the future…as they say, you only live once – it is just about analysing effectively and knowing your limits.

Be honest

Let your pals know that you are trying to save. It may be a scary thing to say – FOMO is real! But, if you are honest and if they are true friends, they will be there by your side to help. Allow them to understand and be on the same page. If they want to go out with you every Thursday night for drinks at that posh club in central – if you are open and share your reality, then what is the problem with going to the local pub instead?

Think small

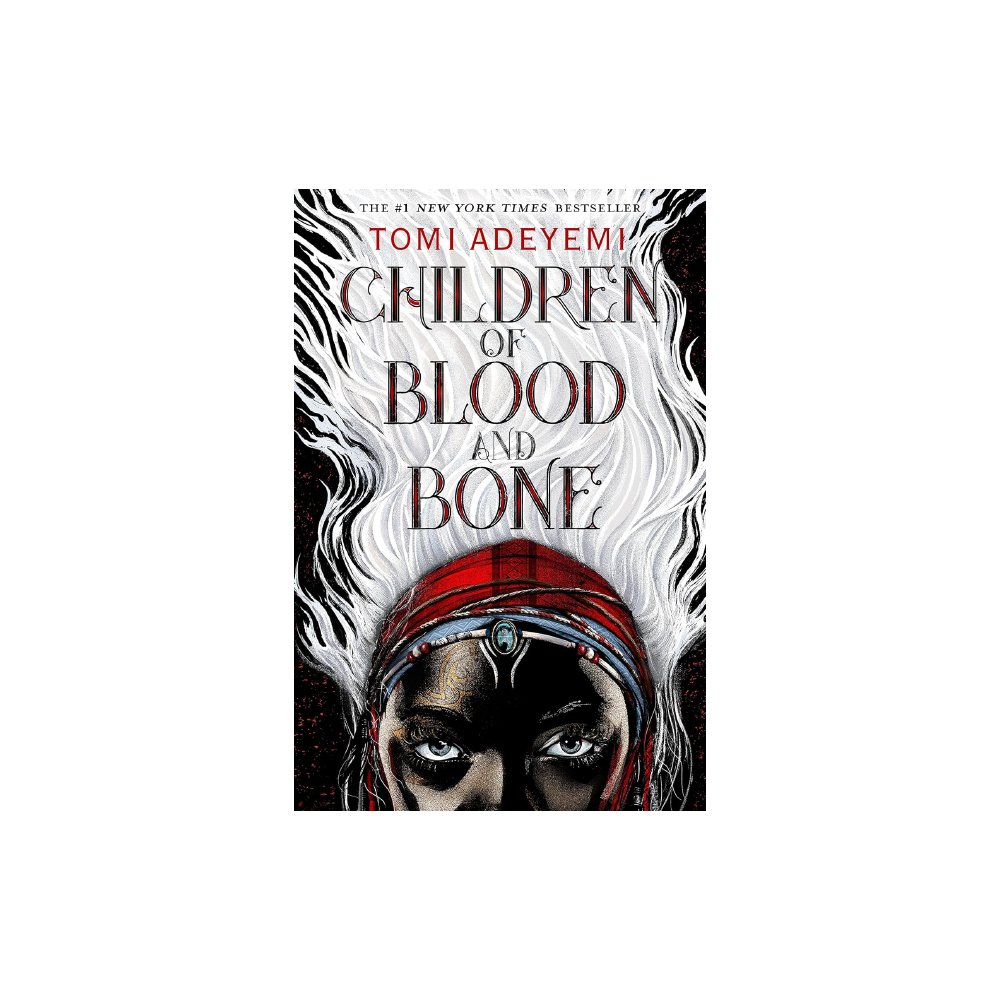

The initial thought when considering having to save for a house is ‘omg I can’t buy this or that– I have to stop spending.’ This may be the picture through a bigger lens but, have you considered smaller than that? There are changes you can make that are smaller, and still contribute.

1. Sell unwanted/unused belongings (clothes, furniture, bags, shoes etc.)

2. Set a challenge up to save just £1 or so a day…£365 by the end of the year – it all adds up!

3. Try an easy-to-start side hustle to earn some money that can go towards your savings

4. Do some simple swaps…instead of buying branded goods, try unbranded and the money saved from that change, put towards the house

Now, you should be able to see, from these tips, that you can still have fun when saving up! The dream can become a reality with not too much compromise, leaving you to get the life you desire and rightfully deserve. The most important part is finding that balance to have the best of both worlds.

So go on – start saving, living your life, and soon enough your own property will follow.