Written by Emiley Phillips

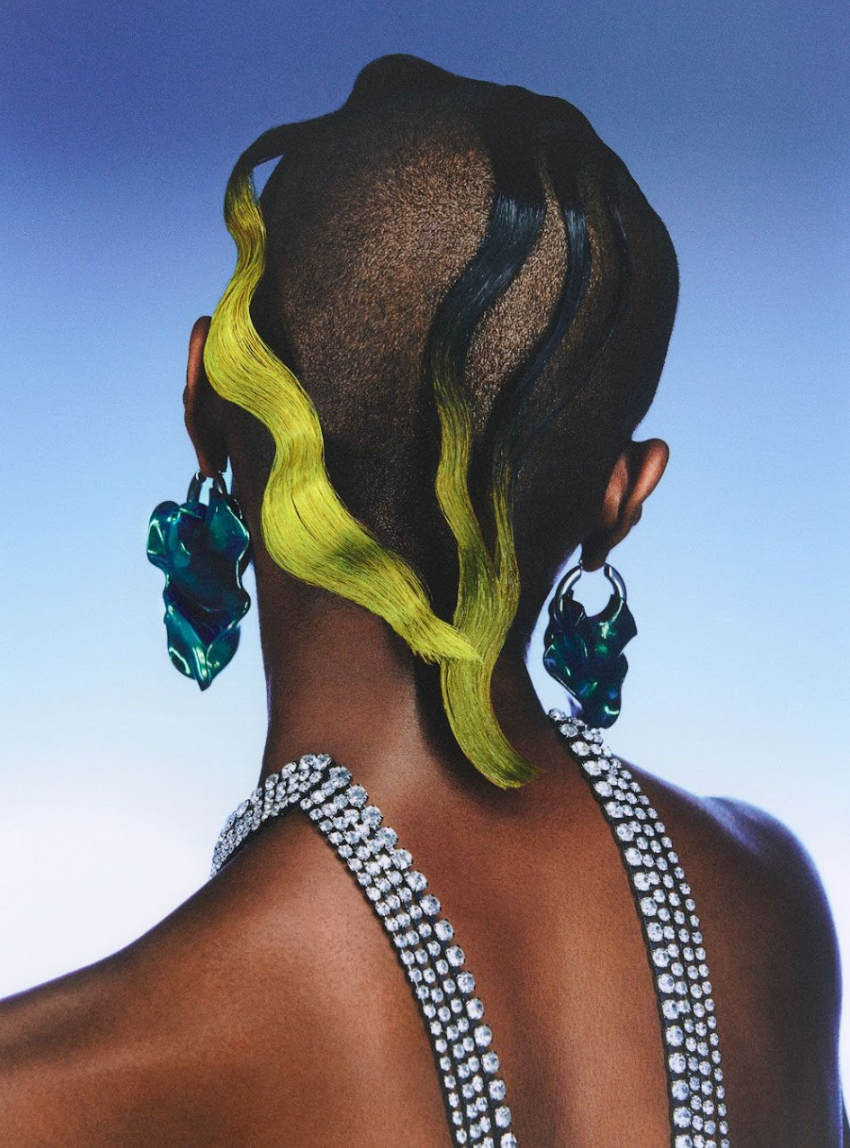

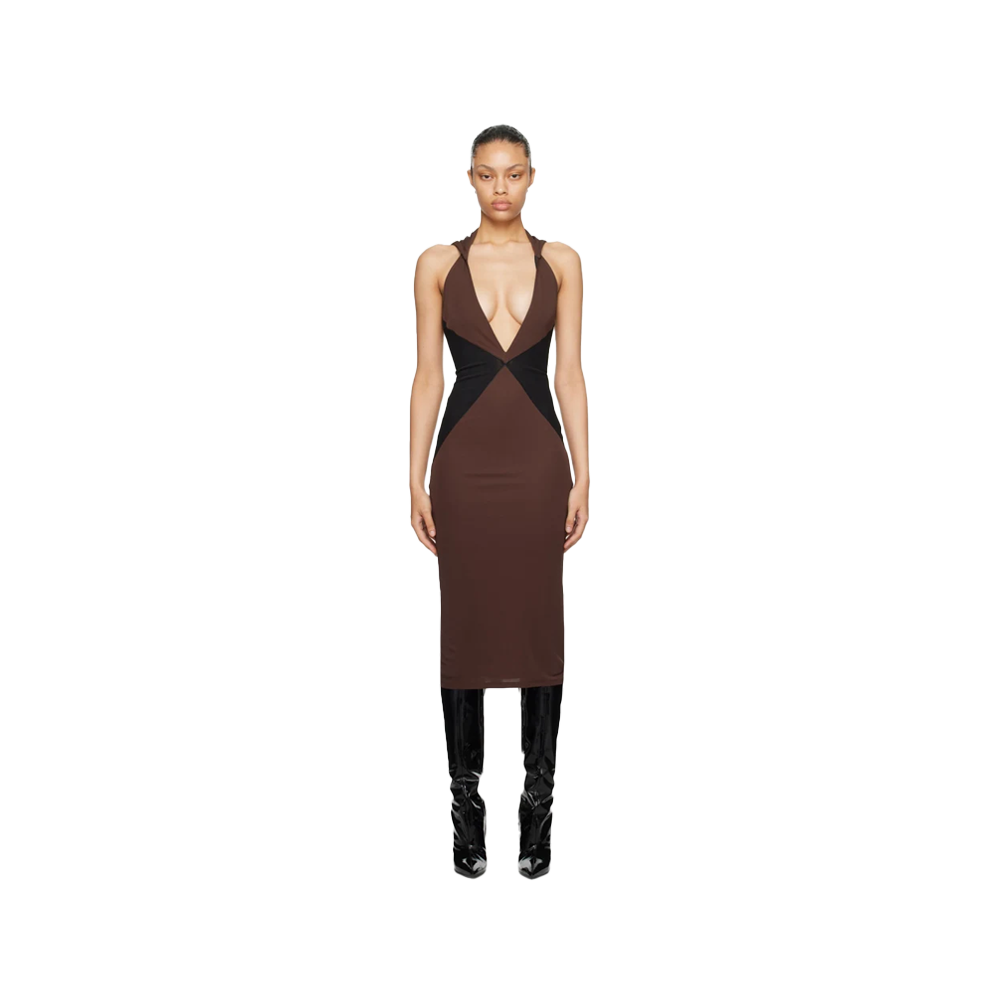

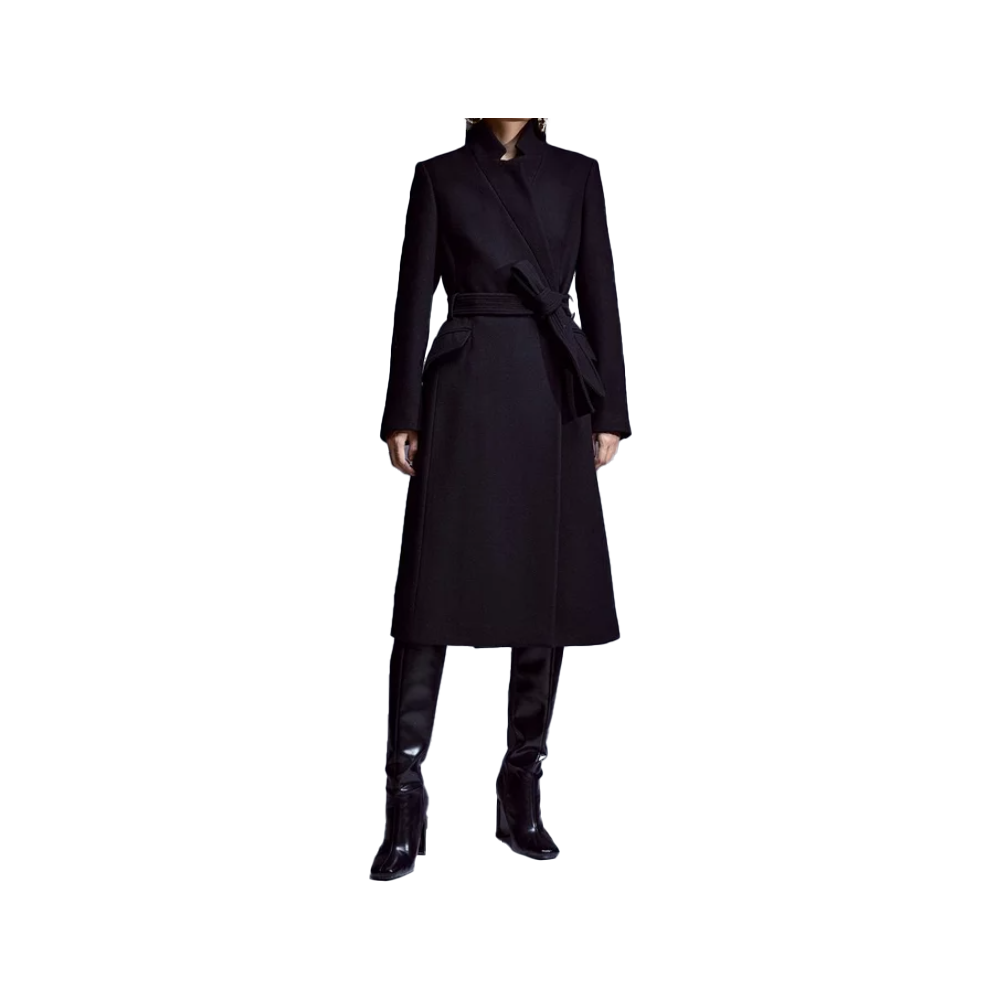

Image by @Threadsstyling

Unhealthy habits can get you into financial trouble, so to keep your finances trouble-free, it is key to follow healthy habits. By doing this you can spend wisely, save well, be free from debt and reach your bigger financial goals faster. Use the control you have over your personal finances, smarter.

Remember, it takes 66 days to turn a behaviour into a habit so this process will not happen overnight. But the sooner you start, the sooner your personal finances can get the healthy boost they need.

Schedule your money minute

Ultimately, each day, and most preferably in the morning, allow yourself time to check your finances to get yourself on track. This can be done by looking at your bank account or just mulling over your budget figures. This will allow you to know each day what money you have available, or not. Let money be on the mind.

By knowing this you can budget your daily activities accordingly…if you were thinking to go out to that posh café for lunch but then realise you have only got £20 in your account, it would be sensible to skip that posh café and go for a more affordable option, so you can make the most of your daily funds and save it for things like transport home etc – unless of course walking back is feasible…but I think not.

Arrange an automatic savings account

Something we all talk about is savings. It’s a great idea to put some of your earnings in savings, and any left-over money for the month. But how many of us actually forget to do so?

Avoid the hassle!

To ensure you build a steady savings amount, set up an automatic transfer. On the day you are paid, or the day following, transfer a set amount each month so that you know whatever happens, you will have that figure in your savings for when the time comes. Literally it can be as simple as it sounds…make one change and then each month you do not have to lift a finger, but rather just let the magic happen.

Facing fears

Every day, do something that scares you. Why? You may ask.

As humans, fear drives our behaviours. So, if you step outside of your comfort zone and face a challenge, something scary and new, you will become less fearful overtime. If you want the psychological name – it is called flooding.

With this, you will gain courage and self-belief which has a positive impact on your personal finances. Ultimately it should allow you to feel more confident and ask for a raise in your salary, or be able to barter if you know a price is too high. Fight for what is right – always!

Change your mindset on purchasing

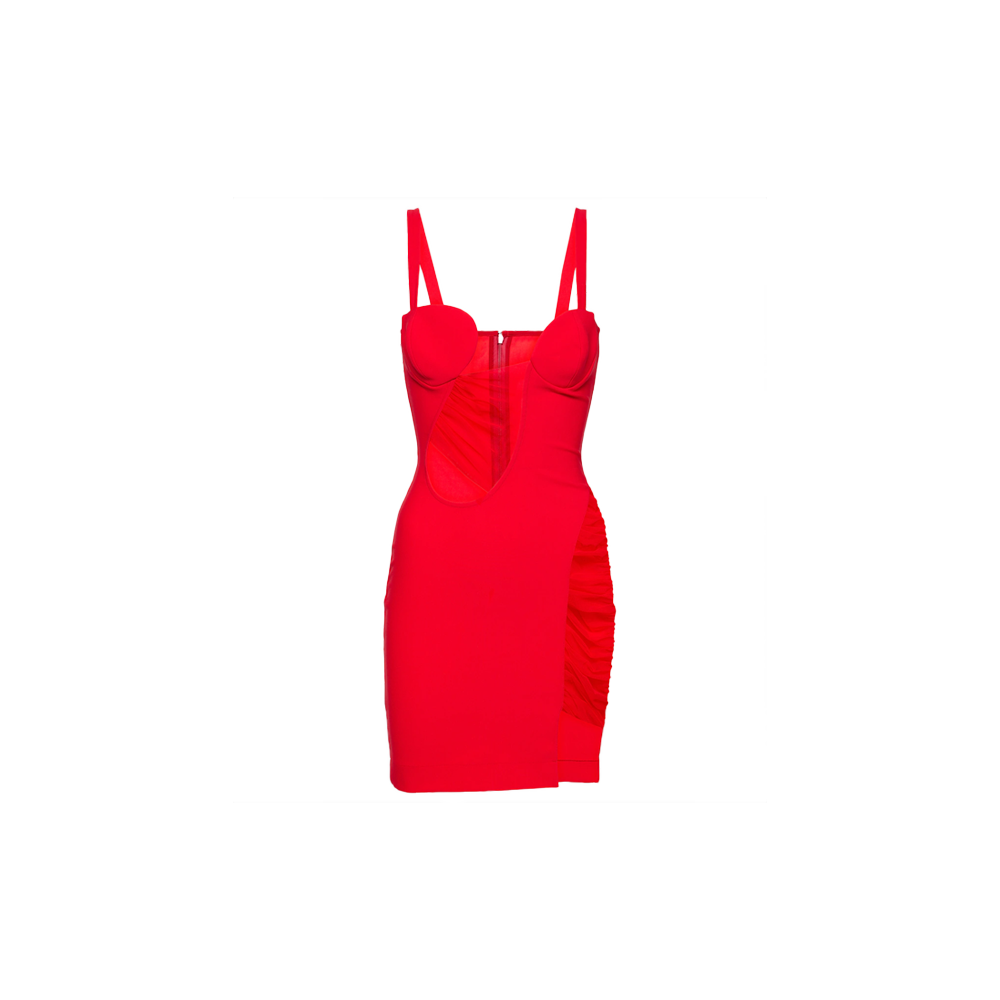

We all fall into the trap. It is difficult to say no when we see the most beautiful dress in the store, or you see a super fun holiday. But it is about using your mental strength and rewiring the thought process that will help you purchase in a healthier fashion.

Instead of thinking of all the reasons why you want to splash out on that purchase, mentally think about the reverse; why it is not such a good idea. Do you REALLY need it now? Or can you wait? Does the purchase amount allow you room for savings still or will it break into that buffer? Is it an impulsive buy or an essential buy? It all adds up.

Of course, treat yourself, you deserve it. But make it every once in a while, and with a budget attached so you do not splash the cash too much.

Set SMART goals

Everyone is sure to have heard of the acronym SMART, for setting goals = Specific, Measurable, Achievable, Realistic, Time-related.

Why not apply this to some financial related goals?

Do you want to pay your debt off by the end of the year? Well set yourself that goal, to pay X amount each month, to X debtor, until that debt is no more. This is just one of many instances you can use.

Think both short term and long term; do you want to save for your future child, or do you just want to settle your finances for the following month and the holiday you have upcoming?

By setting goals in a SMART fashion, it makes them more achievable and better able to be met. There is no limit to how many of these goals you can have too; they can be ordered and prioritised so that those more important and with a shorter time frame are accomplished first.

Read up on the subject

A study found that 87% of teens lack knowledge of personal finance – quite alarming, right? Something that can be very useful for your own personal financial health, is to become literate in personal finance. This does not mean you need to do some sort of accounting degree or studying. It is as simple as reading around the subject via blogs, magazines, books and even podcasts.

I enjoy listening to The UK Personal Finance Show with Phil Anderson and Pennies to Pounds Podcast. A book that I love is Rich Dad Poor Dad by Robert T. Kiyosaki. Totally changed my mindset and introduced me to the personal financing world.

You can learn about saving, where to invest your money, how to make the most of your hard-earned cash, how to manage debt and much more. Become literate and aware of the terminology. It will help a lot, whilst of course making you sound smarter in conversations.

So, there you have many new habits you can implement to your life to improve your personal finances. Something to keep in mind here is that research has shown that if you write down your goals and update a chosen friend or peer weekly on progression, you will be 33% more successful in accomplishing the goal. So, get a goal buddy on hand and off you go. Start as you mean to go on.

In respect of the information above, this content is only for informational purposes and does not constitute any kind of investment advice.