Written by Emiley Phillips

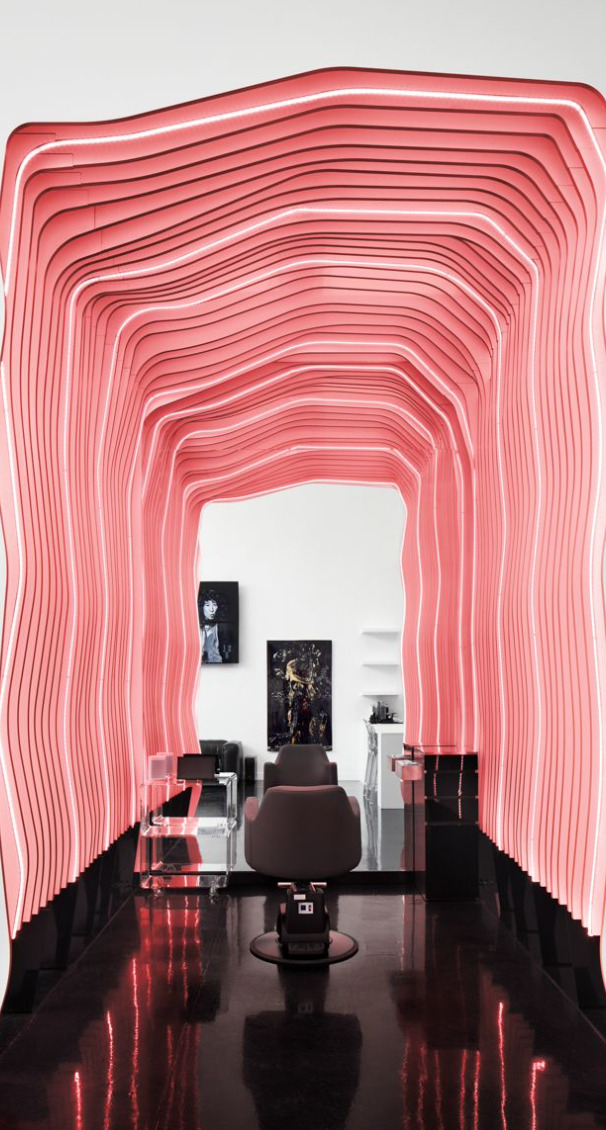

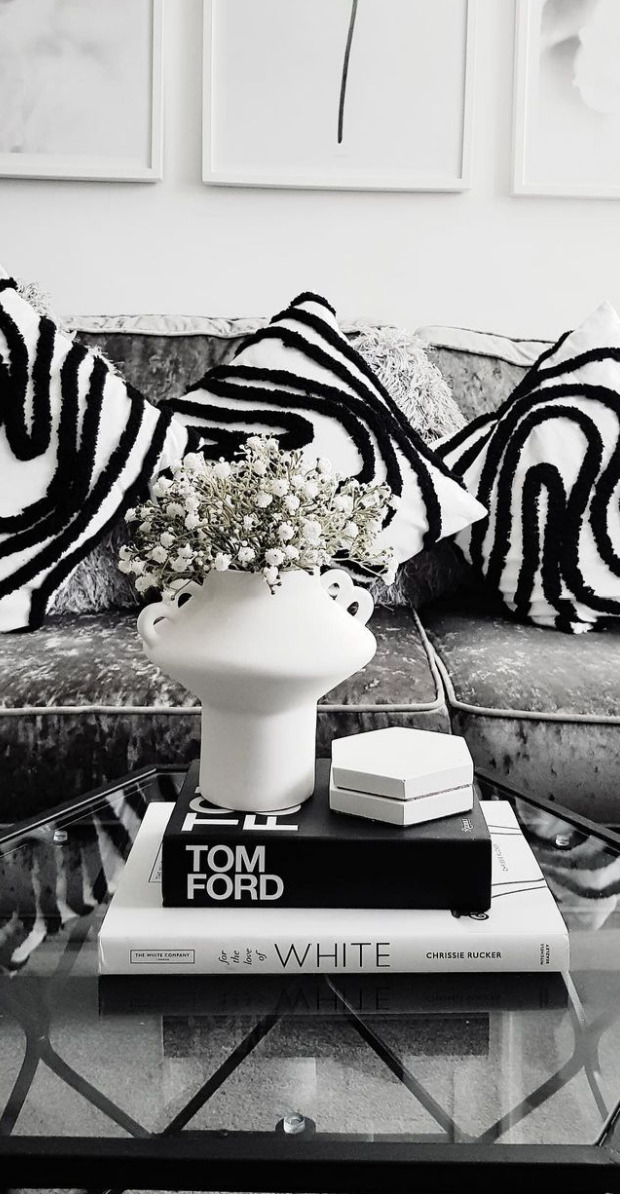

Image by @intdesmag

The housing market feels trickier than ever to navigate and when looking at mortgages it gets even more gloomy. Since September 2022 the UK has been hit by high interest rates, resulting in a fall in demand for new home home loans. Currently, the approval rate of mortgages is at its lowest since 2009. So, you can definitely say that the market is facing tough times.

With this in mind it can be less attractive to buy a property, but believe it or not, we all still need to live somewhere! So, if you are in the process of house-hunting and trying to get yourself a mortgage, here are some top tips to get your mortgage approved quicker (from real life experience!).

1) Consider the type of property you want to buy

When it comes to what works best when you are seeking a mortgage, keep in mind that lenders are more reluctant to lend if they have concerns over the property value decreasing overtime. Ultimately this will make it harder to sell going forward, which is not ideal.

Types of property to avoid:

– Ex-local authority housing

– Homes made from non-standard materials like concrete or with wood and steel frames (think about London’s Barbican complex – lenders are not convinced here in regard to offering a mortgage)

– Properties with more than one kitchen or multi-block buildings (red flags arise that you may rent part of the property out, meaning a breach of the residential mortgage terms)

– Studio flats and flats smaller than 30m2

– Leasehold flats without a management company to look after communal areas

– Properties in need of refurbishment

So in this case, a new build would be a smoother and more promising process…banks seem to be more enthusiastic and cooperative lending to those wanting to purchase a new development, since there is less chance it will lose value. You can get a guarantee and longer lease working in favour.

2) Location, location, location

Back to thinking in the mind of a mortgage lender; certain areas are more risky and so limit the likelihood of a loan being approved.

Number one is for properties located in the town centre. To lenders this instantly equals trouble. Think about it, town centres overtime become crowded, dirty, noisy and places where crime is likely. This isn’t attractive and will make the property harder to sell in the future, making risk here not worthwhile.

Then you come to flats above/next to shops, another nogoer. I actually tried to buy my first flat above a parade of shops and faced this problem first hand. I was told that the location was one of the main reasons no loan was approved for this property. The shops surrounding were a security risk; late at night, groups hanging around the convenience store getting up to no good and having takeaway shops, bringing unwanted smells at all hours. Of course, for myself, as a first-time buyer, I did not see it from this perspective. I was just in love with the flat and upset that my application got rejected. But now it makes sense…all of the pointers that I thought added value to the property (being in a convenient location for necessities) made the property less attractive when coming from a lender’s viewpoint.

New builds in this case would be more attractive to lenders once again, as typically they are built in up and coming areas (at the time of being built anyway!) and also come with long building warranty’s.

3) The property lease terms

If you are not clued up on what a lease is, then read this next line clearly. A lease is the legal document which outlines the rental terms for a commercial or rental property, between the property owner and the renter (landlord and tenant). Ideally, the lease period should cover 75% as a minimum, of the useful life of the asset.

Ultimately, properties with shorter leases, so those with 80 years or left less, are typically harder to renew, meaning lenders are reluctant to lend and approve mortgage applications related. Yep, you guessed it, it is all due to the property being more difficult to sell and its value decreasing.

4) Get your ducks in a row

One of the most crucial considerations when it comes to getting your mortgage approved quicker, comes down to documentation. Not only is it key to be organised and have all of the files prepared and available, but also to complete requested forms in a timely manner, with no mistakes.

Trust me, this part of the process is always the longest, so do what you can to make it a more seamless practice. Take a screenshot, bookmark this blog, keep it to hand and refer back to the following list of documents lenders are likely to want to see:

– Proof of address (e.g. utility bills or credit card bills)

– Proof of deposits (savings account statements)

– ID documents (passports are most preferred)

– Your last three months’ bank statements

– Your last three months’ payslips

– Your last three years’ accounts or tax returns

– Your latest P60 tax form

– Signed employment contracts

– Proof of any bonuses or commission

– A gift letter (for those that are getting help with the deposit – this ensures that the deposit help is a gift and not a loan, which would entitle the giver to own a part of the property)

It’s best to also check what format is acceptable. Some lenders do not accept PDFs or printed bank statements, but rather will only accept original copies by which you will have to request in advance.

And when it comes to application forms and the documents requested in the process; make sure that you are honest in all answers and give the exacts i.e. your full name including middle name/s and stating your exact income. Be sure to declare everything as the lenders will find anything anyway, so if you hold back, it will only lengthen the time for your mortgage to get approved.

Keep a copy of all documents so you can refer back efficiently if needed.

5) Credit history

Finally, a tip that will do you wonders (you can thank me later) – check your credit report before the lender does. When applying for your loan, it is all about being able to show to the lenders that you can pay back the mortgage. Credit checks are crucial.

You will probably have heard of a credit rating; basically this gives you a score of how likely you are able to pay back your debt, and evaluates the credit risk of a prospective debtor. The higher it is, the better! So, ask yourself:

– Have I paid my credit card bills on time? And do I do this consistently?

– Do I have direct debits set up and are these being paid on time?

– Am I ever late paying my rent?

– Have I ever taken out a loan or overdraft? If yes, how recent was this? (if it is less than three months since you are applying then this raises some eyebrows)

– Also, try different credit reporting companies do not soley rely on one (give check my file a go)

Lessons here are to keep your direct debits in order and ultimately just manage your credit well. You never want to have too much available credit, nor too little, as both can cause concern for lenders.

Now, do note that there are many factors that come into play when getting your mortgage approved. Every lender is different. Not always will new builds be more attractive, but it is just more likely from experience (and I am sure your mortgage advisor can help you out here too). By taking all of this into consideration, it should help you understand the reason why your mortgage application is taking time to be approved, and give pointers of what you can do that may speed things up a bit. And if you are just at the start of the process, allow yourself to go in eyes wide open.

Good luck…happy house hunting!