Written by Emiley Phillips

Image by @latto777

We see banks everywhere, digitally and on the high streets, plus, everyone loves to talk about money right… but it can be confusing to know where to put your money, if a credit card is the right way to borrow and how to bank smartly.

A bank is a financial institution that has the license to handle money for consumers and businesses; receiving deposits and providing loans. Some banks are able to offer relevant financial services which may involve currency exchange and wealth management. Most of us use retail banks like Llyods, HSBC, Halifax day to day. They offer loans and provide credit cards. You can also take out a savings account here.

Corporate banks including Metrobank and Santander are useful for business customers. They can provide credit to manage the cash flow of companies and some offer foreign exchange services, if necessary, for their customers. Investment banks like JP Morgan Chase are mainly for businesses looking to raise capital in financial markets and primarily used if companies wish to go public or sell debt to investors. Online banks or ‘challenger’ banks like Monzo are relatively new to the market and provide online services only via an app.

According to statistics, 97% of the UK population have a day-to-day bank account, making them pretty necessary and unavoidable in one’s daily life. This being said, there is not a one-size-fits-all approach, and the key to making your money and savings work for you could be down to the type of account you have.

Tell me more!

Basic current accounts are, as the name suggests, basic. You get access to the essential features of banking with no monthly fee. Current accounts tend to be used for any daily banking needs which includes depositing and withdrawing cash, setting up direct debits and receiving automated payments i.e., salary.

Savings accounts allow you to earn interest from the money you put into them. There are multiple choices when it comes to types of savings accounts i.e., ISA, fixed rate bonds, regular, easy access. The variations are on the ease of withdrawing the money and the rate of interest/term.

Some top advice, when considering the best bank account to choose, is to compare the following factors; interest rate, minimum/maximum account buffers, ongoing fees, convenience, benefits/packages, and customer service.

Most current accounts or credit card accounts provide you with a bank card. People often have more than one account and therefore will have multiple bank cards.

What types are there?

ATM card – issued by a bank to allow flexibility for the customer, the card can be used any time via an ATM. It is important to check your bank has ATM use approved or else there may be additional fees for use.

Debit card – combines the purpose of an ATM card and a cheque. It allows you to make a purchase and have the funds immediately withdrawn from the bank account. Users of this card should be aware of their limits to avoid overspending which brings penalties.

Credit card – this is essentially a loan given to the card user. Most have a credit limit attached, this will vary based on your credit history and ability to repay. The card issuing company expects a minimum payment billed per month with an interest rate attached on the amount owed (which is zero if the amount can be paid in full).

Prepaid debit card – the card has a predetermined amount which can then be spent as like any other credit or debit card, until the money reaches zero, at which point it needs to be topped up.

What should I choose?

So, in terms of what works best, this will come down to your individual needs. What are you looking for? What do you require? If you need to borrow money, how long will it take you to realistically pay off the loan? Have a think and then choose accordingly. Remember, there are many advisors out there to help you if you need further assistance.

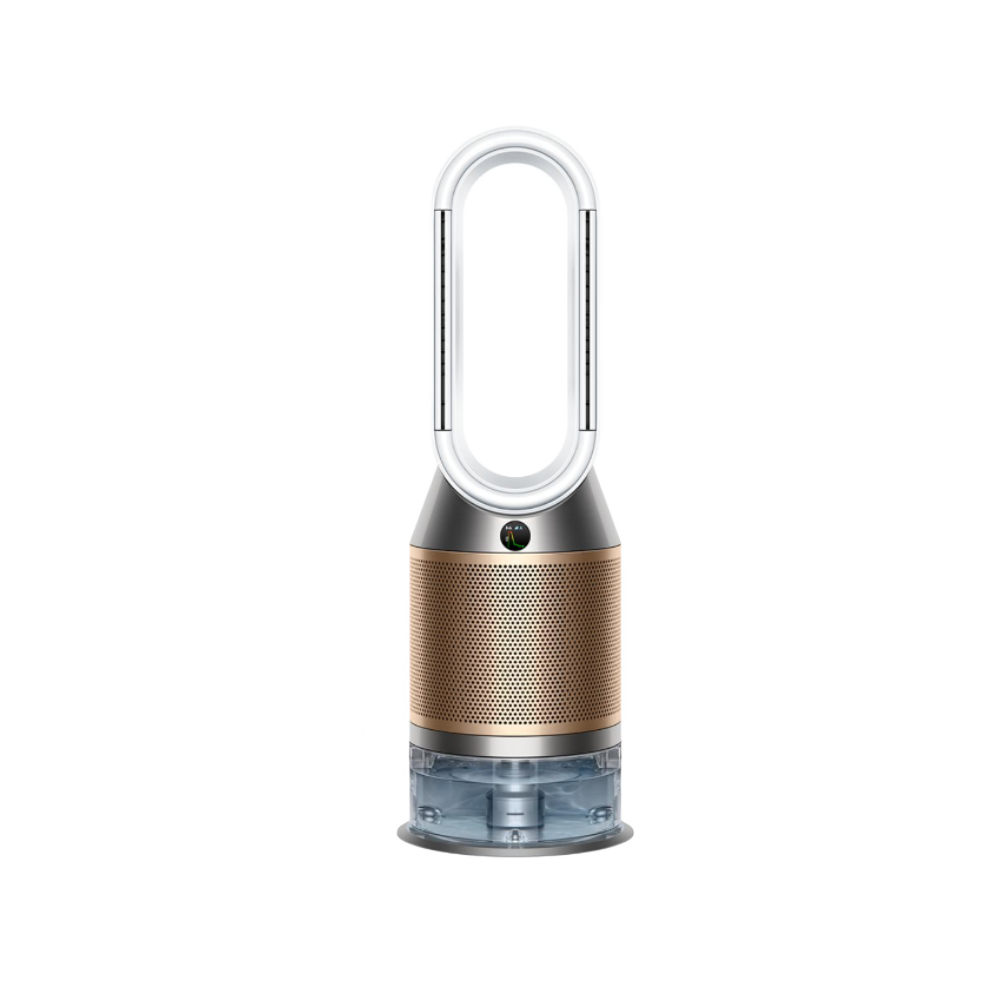

Banking and paying for things has come on a lot in recent years. Follow the fashion and use contactless payments – simple, quick and safe, what more could you need?! Plus…it works abroad too. Use a card rather than cash. You may ask, why? Well, it is not only safer but also provides protection. If you pay via Visa Debit for goods or services, if these get damaged, payment can be recovered (situation dependent).

Get involved with e-statements. Gone are the days of filing paper copies! Accessing your statements online means they’re all in one place, saves space and the environment. Lastly, make the most of the online services, tools and apps available. They’re hugely convenient. By using the digital services, you avoid having to find the time to go into a branch allowing you to do your banking from the comfort of your own home.

There’s a big world of banking out there waiting for us to make best use of it. What are you waiting for? Start today!