Written by Emiley Phillips

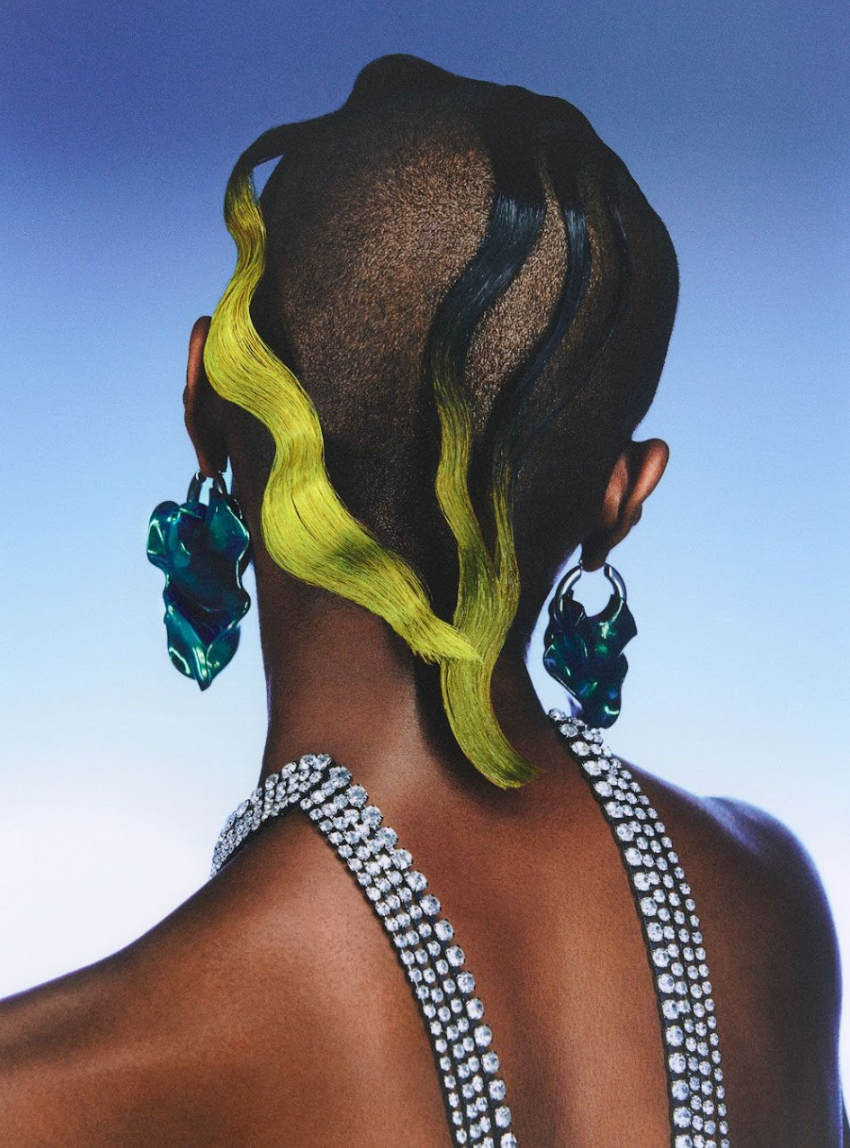

Image by @1Dessdior

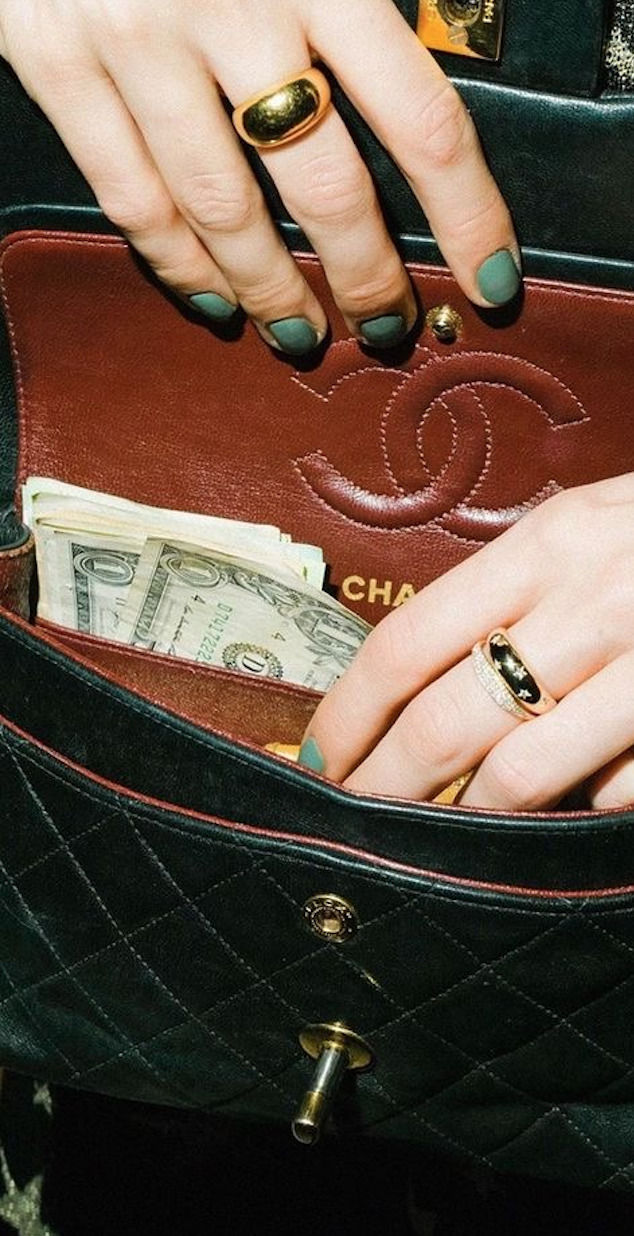

In the cost-of-living crisis we’re facing right now, it is more important than ever to make the most of your hard-earned cash, don’t you agree? It’s all well and good the money sitting there and looking pretty in your bank account, but what you really need to understand is how to invest your money and where to get the highest (most beneficial) return.

This doesn’t always involve property! So here are some alternatives for you…

Businesses

Given we are living in an era of an entrepreneurial nature, one of the best ways to invest your money for a worthwhile return is to invest it into businesses and help them to raise capital. One way you can do this is crowdfunding. Use your money to invest in new business ideas that you like the sound of and believe will do well. As the investor, you then make money through the dividend, equity or interest pay-out. There are many sites that facilitate this option, such as Indiegogo, Crowdcube and GoFundMe.

Alternatively, you can go down the peer-to-peer lending route. This means using your money to lend to others who use that to settle a pay-out they may have. This option is attractive because it’s easier for individuals, so a higher rate of interest can be charged by investors, hence giving a desirable return rate.

High interest savings accounts

High interest savings accounts can be used to boost savings. Some UK providers include Virgin Money, Nationwide and Santander. When considering this option, it really comes down to how much you want to save, what you are saving for and the necessity for accessing the money.

These types of accounts are good as they come hassle free, are typically online and allow a more attractive return rate compared to a current or standard savings account. The drawback is that they often include clauses such as less flexibility to withdraw when you like, so if you needed to dip into the money invested here, it would not be so simple to do so.

The Stock Market

If you are feeling brave and ready to take a risk for the benefit of a higher investment return, the stock market is about to become your new favourite place. You can create your own portfolio, and also use tools that allow you to follow others, but ultimately a thorough understanding of the stock market is critical to make the investment here worthwhile.

You simply invest and buy shares in companies. Following the path of the stock market and its volatility, will determine your return. Your return comes from the dividends paid by the companies in your portfolio, or you can make profit by selling your shares for more than what you purchased them for.

Investment ISAs

Often introduced to Gen-Z as they start their savings path, ISAs; Individual Savings Accounts are known as tax wrappers because legally with these mechanisms, you pay less tax.

There are four types of ISAs; cash, lifetime, stocks and shares and innovative finance ISAs. Each tax year you can put money into one of each kind. For the current tax year, 2022-23 there is a maximum of £20,000 that can be saved via an ISA.

You can get a satisfactory return from the interest – depending on the investment amount and interest rate in question.

Pension

Investing in your pension is a tax-efficient way to invest – for every penny you save, the government gives you free cash in the form of tax relief. If you top up your pension then you can boost your retirement fund, giving greater return for the future.

If you are employed and enrolled on a workplace pension scheme, you can boost your contributions and if you’re lucky, your employer will also do so. You can also just pay in extra money to your pot without having to boost your contributions.

Alternatively, a private pension may be an option, to allow you to grow your money and have an income when you retire. Look into a personal pension plan or a self-invested personal pension.

So, now you’ve been introduced to five different ways you can consider investing your money, to get a high return. Whilst it sounds good and you may want to go for the simplest option, take time to evaluate and analyse, particularly taking into account your current situation in today’s economic landscape.

Whatever you do with your money shall be up to you… just be sure to do something. Don’t miss out on the benefits, big or small, of investing. You can thank me later!

In respect of the information above, this content is only for informational purposes and does not constitute any kind of investment advice.