Written by Emiley Phillips

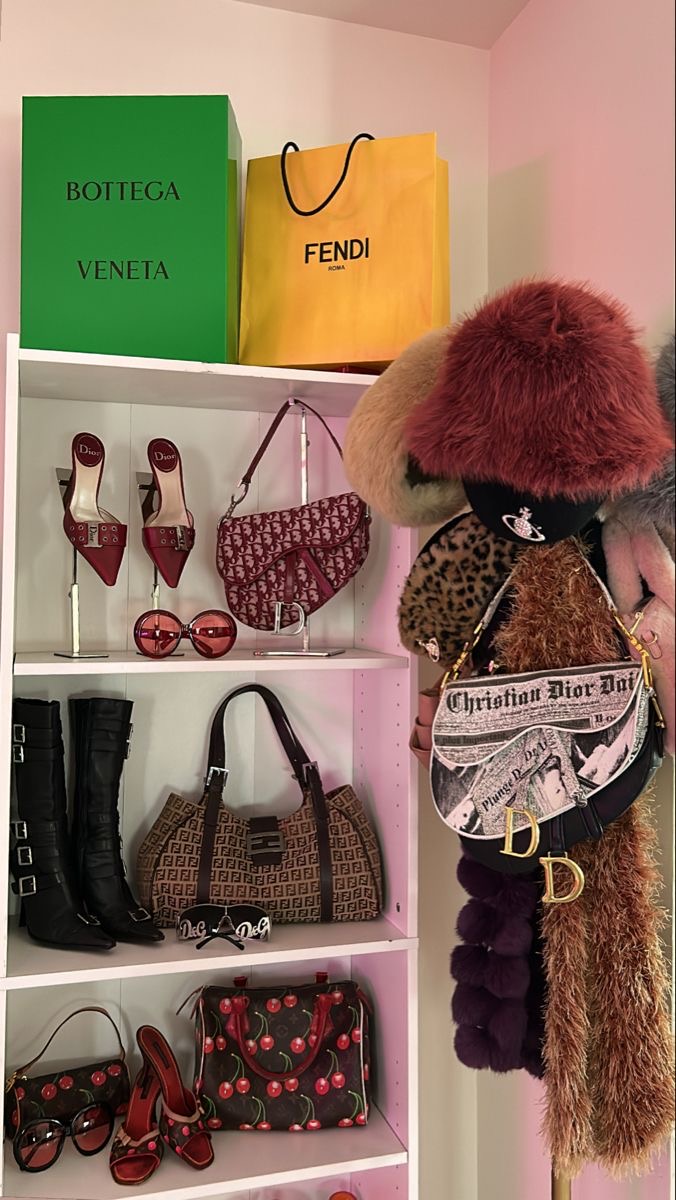

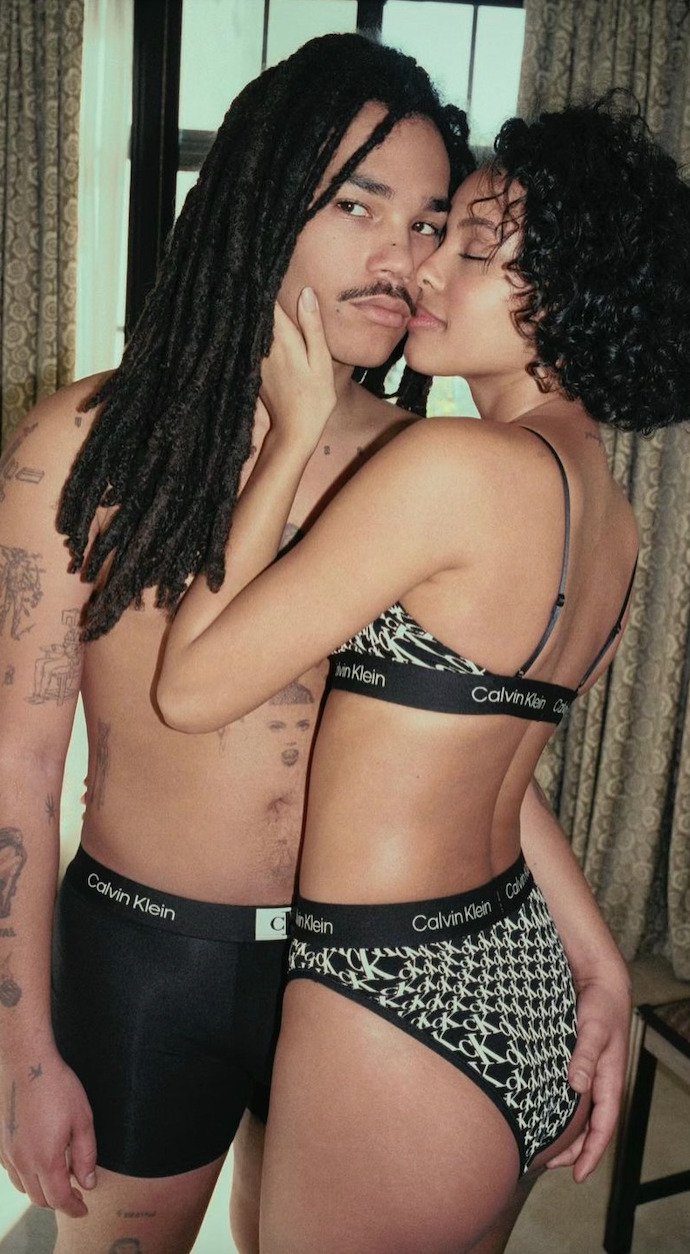

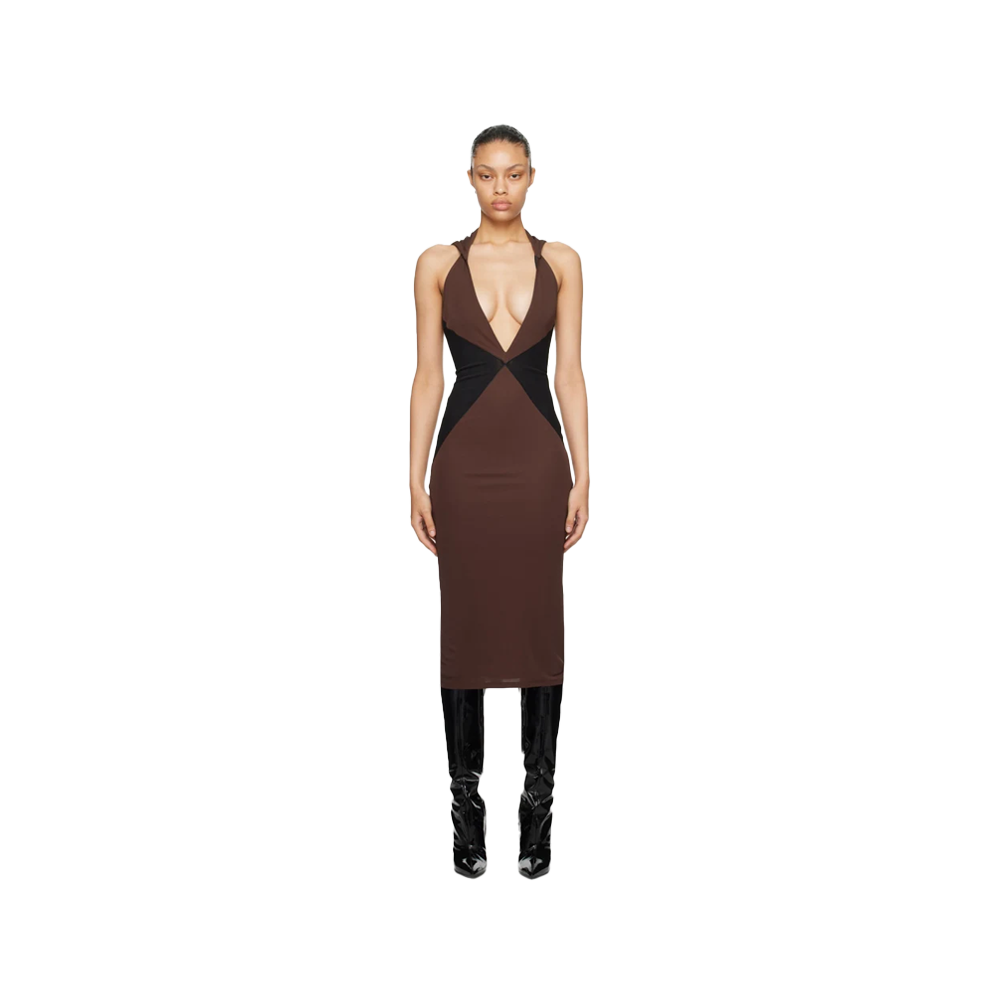

Image by @chey_maya

Now, you have all heard the phrase, ‘money is the root of all evil’ and I am sure you’ll agree how true and relevant it is. Unfortunately, money can be a real hindrance in families, friendships, opportunities and even relationships. Apparently 44% of people avoid talking about money with their partner! But you don’t need to be worried because I’m here to give you the lowdown on how to address that awkward money conversation and avoid any evil in your relationship.

At the start of a relationship (talking romantically here), it is all about getting to know one another, spending time together and testing compatibility. As the relationship develops, life gets more serious, and commitments arise. For example, thinking about going on holiday together, or moving out, even little things like buying gifts for one another. When it comes to committing to these bigger expenses, that’s when more private, personal information (like debts, income, working capital etc.) come into play. Say you are ready for a 2-week luxury Caribbean break. But he’s only budgeting for a shorter, closer city break. This works the same with ideas for moving out; do you have the same goals, will you both be financially stable to buy the place of your dreams.

There is a lot to think about and it won’t necessarily be straightforward…

1) Plan the conversation

It might sound stupid but it is something we all have to address as it is a key part of the relationship and your future together. So break the ice, don’t let money become a taboo topic, just put it out there and say on X evening, after dinner let’s have a discussion about our finances. It’s time to get real…no more beating around the bush and shying around the topic.

2) Choose an appropriate time & location

Of course, you do not want to reveal all this information to everyone you date, it should just be to the one you feel a commitment with and want to be involved with for the long term. So, if you are recently engaged or planning to move in together, then you should have had this discussion already! Remember, a private place is best too. It should be just the two of you!

3) Talk goals

You want to have some sort of agenda; going in full steam ahead ready to just blurt out your income, debt, savings etc, is too much. You need to turn it into a discussion and find out each other’s perspectives. Here it is important to include asking about one another’s financial goals. What do you want for the future? What is your ‘dream’ lifestyle? What do they see for themselves? And how can this be aligned?

4) Expect to have different opinions

Often, your money goals will not align. There will be one saver and one spender: it’s common! Listen and take turns to speak so arguments don’t arise and you don’t forget to acknowledge their opinion. It’s about understanding that and then making any financial decisions together. For example, the saver would naturally avoid any expense possible, whereas the spender would buy anything and everything desired. If you followed the habits of the saver, then ok, you would have money, lots of it – BUT no life. If you went with the habits of the spender on the other hand, you would have little money BUT a fun life. So neither is sustainable. It is about finding a middle ground, together.

5) Make a plan

Talking is one thing but actions and incorporating the practical side is key. What will come from the discussion? Consider, (depending on your comfort level), introducing a joint bank account. Monzo is great for this, it’s so easy to set up and super user friendly to keep on track of. When you get to the level of buying a house, paying bills, arranging holidays…having a joint card makes it simple. Rather than fussing over who owes what.

Another idea is to each put an agreed amount of your salary into the joint account each month, allowing for individual leftovers/savings. This pot of money can then be used for any monthly outgoings you build up together; so bills, mortgage, dinners out, presents, petrol – the list goes on. This way, you are both contributing equally.

Some of my friends have followed in this example, but others, who wish to keep finances separate, would rather just decide who pays for what i.e. one pays for the monthly shopping, and the other pays the monthly electric bill.

The idea of introducing finances and money to your relationship gauges mixed opinions. Some people prefer to keep it private and separate. Whether they have millions or zilch, it is personal. Yet others are totally fine with sharing this detail. Each to their own. However, if it’s on your mind. Go get it…bust open that conversation, get it out of the way, expose the financial truth and work on it together.

In respect of the information above, this content is only for informational purposes and does not constitute any kind of financial advice.